Innovation and digital technologies are helping to reduce friction and lower costs in the global financial system, plugging more people into the financial infrastructure that could enable them to thrive.

The potential economic benefits of greater financial inclusion are vast. For example, connecting the world’s ‘unbanked’ population to banking products could add US$250bn to global gross domestic product (GDP) – about the same as the Portuguese economy.1,2 This translates into large opportunities for companies that can offer innovative solutions to finance-related challenges.

Two of these opportunities – extending access to banking and enabling people to plan for their financial futures – centre on emerging markets, where financial security is generally lower. Another two – making payments more efficient and secure, and improving credit data – are global in nature. Where financial services companies can address evolving needs and enable better outcomes for customers, we believe they can benefit from structural drivers of long-term demand as the world’s population becomes richer, older and better connected.

Banking the emerging billions

The ability to save money securely and borrow it on competitive terms is widely taken for granted. Yet over 1.4bn adults remain unbanked globally, mostly in rural regions of developing economies.3 Good progress has been made in extending essential financial services into hard-to-reach areas over the past decade, largely courtesy of technological advances. The advent of mobile banking has enabled pioneering mobile money services, like Safaricom’s M-Pesa in east Africa, to overcome geographical barriers. M-Pesa, which allows users to send and receive money and apply for short-term loans (among other services) via their phones, has helped propel Kenya’s financial inclusion rate from 26% in 2006 to 84% in 2021.4 Across developing economies, the share of adults with mobile-only accounts more than doubled between 2017 and 2021 (see chart below).

Source: Global Findex Database 2021

Chart subhead: Adults with mobile and traditional accounts, 2014-2021 (%)

Overview:

The stacked bar chart shows the percentage of populations in developing economies, high-income economies, and globally with mobile and traditional bank accounts in 2014, 2017 and 2021. The portion with mobile accounts more than doubled in developing economies and globally between 2017 and 2021.

Adults with an account

| Year | Region | Indicator | % with account |

| 2014 | World | Mobile money account (% age 15+) | 2.06% |

| 2014 | Developing | Mobile money account (% age 15+) | 2.48% |

| 2017 | World | Mobile money account (% age 15+) | 4.35% |

| 2017 | Developing | Mobile money account (% age 15+) | 5.16% |

| 2021 | World | Mobile money account (% age 15+) | 10.24% |

| 2021 | Developing | Mobile money account (% age 15+) | 12.51% |

| 2014 | Developing | Financial institution account (% age 15+) | 54.00% |

| 2014 | World | Financial institution account (% age 15+) | 61.12% |

| 2017 | Developing | Financial institution account (% age 15+) | 61.28% |

| 2017 | World | Financial institution account (% age 15+) | 67.10% |

| 2021 | Developing | Financial institution account (% age 15+) | 68.63% |

| 2021 | World | Financial institution account (% age 15+) | 73.97% |

| 2014 | High income | Financial institution account (% age 15+) | 92.79% |

| 2017 | High income | Financial institution account (% age 15+) | 93.65% |

| 2021 | High income | Financial institution account (% age 15+) | 96.35% |

Companies that can leverage technology to meet unmet demand for banking services have found significant opportunities across developing economies. For example, Bank Rakyat Indonesia (BRI) has built a hybrid business model in Indonesia, which, due in part to its vast archipelago of more than 17,000 islands, is home to the world’s third-largest underbanked population.5

BRI combines in-person and digital capabilities through a network of nearly 7,000 microfinance outlets and more than 600,000 agents across rural, remote and disadvantaged areas.6 Microfinance is a vital part of Indonesia’s economic development: loans to microenterprises grew nearly 12% between 2014 and 2019, while loans to small, medium-sized and large enterprises decreased.7 While microfinance globally has been mired in controversies, Indonesia’s second-largest bank by total assets emphasises responsible lending practices.8

Providing for more secure, healthier ageing

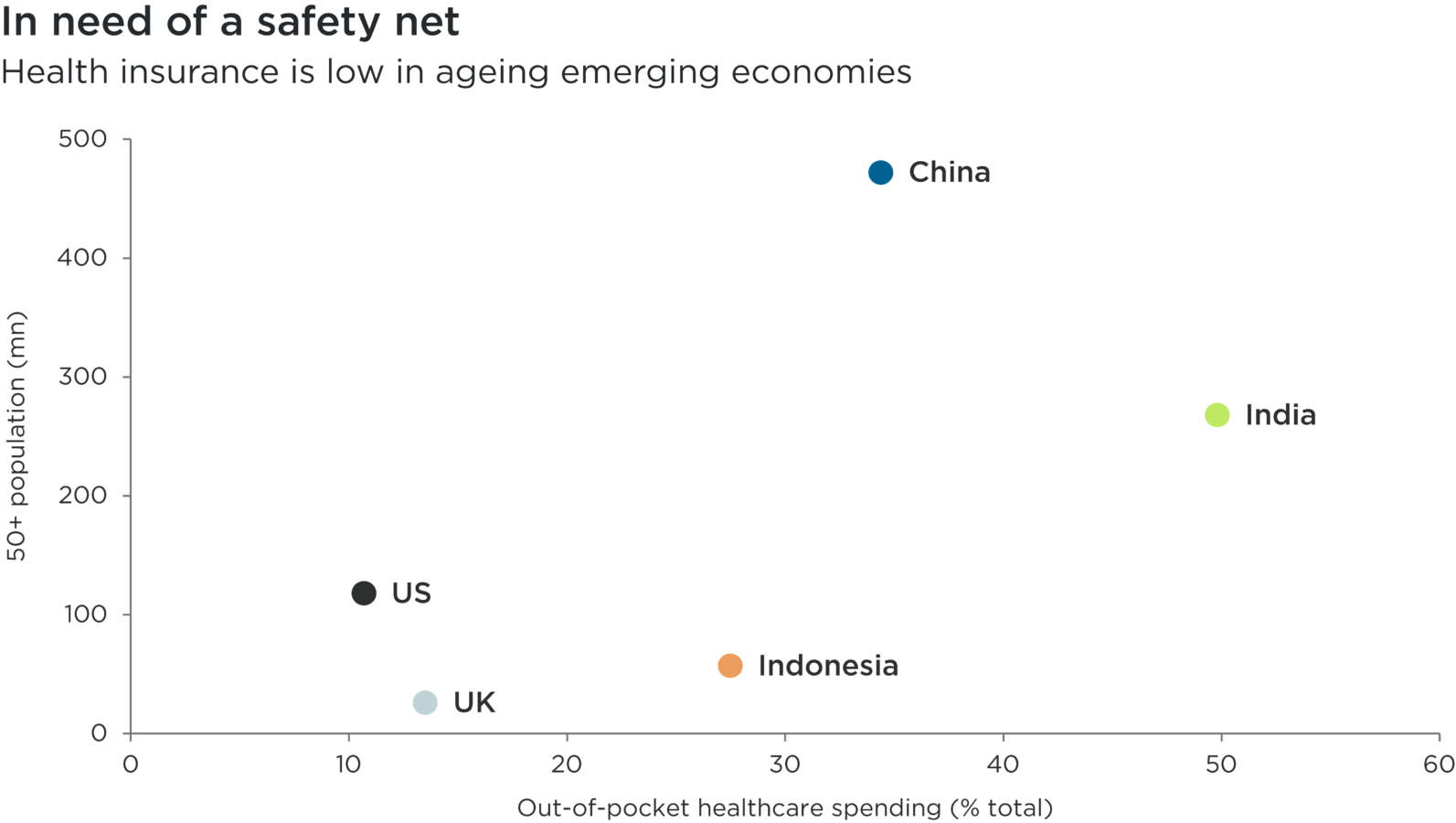

As the global middle class rapidly expands, so does demand for products that support more financially secure and healthier ageing, creating a breadth of opportunities for banking and insurance companies. The global population is quickly getting older, especially in many emerging markets where governments offer very limited healthcare and social security. The upshot is that out-of-pocket health-related expenditure is proportionally much higher than in more developed economies. The World Health Organisation estimates that out-of-pocket health spending across Asia is approximately four times the level in the US, in relative terms.9

Sources: World Health Organization, Regional Health Observatory, 2023 & AARP, 2020

Chart subhead: Health insurance is low in ageing emerging economies

Overview:

The chart shows the percentage of healthcare expense that is out-of-pocket for people in China, India, Indonesia, the UK and the US. It plots this number on the X axis, and the millions of people over 50 years old in each country (in 2020) on the Y axis.

Healthy opportunity

| Out-of-pocket as % of total health spend | 50+ population (millions) | |

| China | 34.39 | 472 |

| India | 49.82 | 267.7 |

| Indonesia | 27.49 | 56.7 |

| UK | 13.51 | 25.7 |

| US | 10.7 | 117.8 |

The chart shows that China and India have hundreds of millions of seniors who are paying significantly more (about a third and half, respectively) of their own healthcare expenses than those in the US and the UK (about 10% and 14% respectively).

Demographic trends point towards a growing opportunity for solutions providers. In China, for example, the population of over-60s is forecast to exceed 400mn by 2040, up from 254mn in 2019.10 Rising wealth is boosting the purchasing power of older generations: the amount spent by seniors in China alone is expected to grow from US$4.5tn in 2020 to US$15tn by 2050.11

Hong Kong-based insurer AIA focuses on Asian countries with very shallow safety nets, offering accident protection, health and life insurance as well as retirement and savings solutions.12 13 Its Vitality programme incentivises active lifestyle choices, rewarding customers with travel, gym and insurance discounts. This system supports customer loyalty and, alongside AIA’s product suite, enables Asia’s emerging middle class to better meet healthcare challenges and plan for their financial futures.

Money spent on insurance premiums equates to only 3% of GDP in Asian countries (excluding Japan), compared with 8% in developed countries overall.14 The gap between insurance required and that provided in Asia is estimated at US$1.8trn for health and protection and US$8.3trn for life insurance.15

Making transactions frictionless and secure

Innovative technologies and digital infrastructure have ushered in a new era of low-cost, secure payments. Expanding internet access – which nearly doubled from 35% of the global population in 2013 to 67% in 2023 – is enabling digital alternatives to cash and cards to reach more individuals and small businesses across the world.16

Electronic payments are faster and cheaper than traditional methods, so can boost economic participation and help small businesses reach new markets. Electronic payments can also improve accountability, but they typically require a multi-step back-end authorisation process. Historically, these security checks have taken the form of a patchwork quilt whose pattern and stitching vary by region, introducing the potential for fraud at every seam.

Netherlands-based Adyen offers a globally integrated multi-channel payments platform: you could buy an item online with a US credit card and return in-store in Europe. Its end-to-end solution means the data analytics that detect fraud and decline transactions can be laser-focused and more secure than many competitors. One Australian retailer reduced fraud from nearly 3.5% to under 0.1% using Adyen’s platform, driving annual savings of US$1.4mn.17

The digital payments market is growing rapidly, capturing a rising share of global payments. Transaction volumes for electronic payments rose on average by 17% between 2017 and 2022, versus 6% a year for payments overall.18

Improving access to credit

In the absence of reliable information, potential borrowers can be locked out from loans they may need to build their businesses or to buy a home or car. The companies that gather and package personal financial data can play an important role in connecting lenders and borrowers, removing barriers to finance for both businesses and individuals.

UK-listed Experian is the world’s largest credit bureau by market share, offering credit data services to financial intermediaries and consumers.19 Its direct-to-consumer products, accessible on digital platforms, promote financial inclusion by supporting identity protection and debt renegotiation. These products have seen notable growth in emerging economies – Experian’s consumer services business in Latin America grew at a compound annual rate of 71% from 2019 to 2023.20

One such product, Experian Boost, is designed to help consumers improve their access to credit without taking a loan. By making on-time online payments for utilities, rent and streaming services, users have improved their FICO credit scores by an average of 13 points using the tool.21

As well as offering services that can unlock access to loans, credit bureaus also play an important role in fraud prevention. Experian estimates that its consumer products prevented US$12bn in fraud in 2023.22

Strict regulations governing how personal financial data is handled and used has contributed to a stable competitive environment among the leading global credit bureaus. As household debts and loans continue to grow as a percentage of developed economies’ GDPs, these companies can act as an important data bridge connecting lenders and borrowers.23

Reinforcing the transition

Innovative financial services and technologies can continue to broaden financial inclusion, while making global commerce more efficient and more secure. We expect secular trends, namely the digitalisation of the global economy and the expanding and ageing Asian middle class, to provide long-term tailwinds for providers of these solutions.

By enabling better financial inclusion, these companies can also unlock and underpin a self-reinforcing cycle of greater opportunity. After all, a more prosperous and digitally connected customer base should support growing demand for financial services. Ultimately, it is our conviction that companies whose services improve access to finance can thrive alongside their customers, catalysing social mobility and propelling the transition to a more inclusive economy.

- Oxford Economics and Juvo, 2019: The ‘YES’ Economy: Giving the world financial identity ↩︎

- World Bank, 2023 ↩︎

- World Bank, July 2022: COVID-19 Boosted the Adoption of Digital Financial Services ↩︎

- McKinsey, 2022: Driven by purpose: 15 years of M‑Pesa’s evolution ↩︎

- EY, December 2022: Riding the wave of Indonesia’s financial services growth ↩︎

- Bank Rakyat Indonesia, December 2023: How Ultra Micro Holding Connects Finance to Millions in Indonesia. Harvard Business Review ↩︎

- OECD iLibrary, 2022: Financing SMEs and Entrepreneurs 2022: An OECD Scoreboard ↩︎

- Statista, 2023: Largest banks in Indonesia as of third quarter 2023, by total assets ↩︎

- World Health Organisation Global Health Observatory data repository, 2018: Out of pocket as % of total health expenditure. Asia calculated as the average of country out of pocket percentages ↩︎

- The Lancet, 26 November 2022: Population ageing in China: crisis or opportunity? ↩︎

- Fengler, W., January 2021: The silver economy is coming of age: A look at the growing spending power of seniors, Brookings ↩︎

- AIA, March 2023: Annual Results ↩︎

- AIA, March 2023: Annual Results ↩︎

- Swiss Re, October 2018: The health protection gap in Asia: A modelled exposure of USD 1.8trn; Swiss Re, July 2020: Closing Asia’s mortality protection gap ↩︎

- Ibid ↩︎

- World Bank, 2023. Share of the population using the Internet – International Telecommunication Union ↩︎

- Adyen, 2023: How a leading Australian retailer saved over $1.4m annually with unified commerce ↩︎

- McKinsey, September 2023: On the cusp of the next payments era: Future opportunities for banks ↩︎

- Shelley, M., 2022: Which Credit Bureau Is Used Most?, Sofi Learn.

Banks.com and Chase.com, from the web, February 2024 ↩︎ - Experian, 2023: Annual Report ↩︎

- Experian, 2023. The FICO Score is a measure of consumer credit risk that is used for around 90% of loan decisions in the US. It has a base range of 300 to 850. The higher the score, the lower the perceived lending risk. ↩︎

- Experian, 2023: Annual Report ↩︎

- IMF, 2023: Household debt, loans and debt securities ↩︎

References to specific securities are for illustrative purposes only and should not be considered as a recommendation to buy or sell. Nothing presented herein is intended to constitute investment advice and no investment decision should be made solely based on this information. Nothing presented should be construed as a recommendation to purchase or sell a particular type of security or follow any investment technique or strategy. Information presented herein reflects Impax Asset Management’s views at a particular time. Such views are subject to change at any point and Impax Asset Management shall not be obligated to provide any notice. Any forward-looking statements or forecasts are based on assumptions and actual results are expected to vary. While Impax Asset Management has used reasonable efforts to obtain information from reliable sources, we make no representations or warranties as to the accuracy, reliability or completeness of third-party information presented herein. No guarantee of investment performance is being provided and no inference to the contrary should be made.

United States

United States